EthereumTechnical Analysis

ETH dips slightly as Trump ends Canada trade talks, but equities show strength

Ethereum price today: $2,410

- Ethereum briefly dropped below $2,400, but equities fared well after President Trump terminated trade talks with Canada.

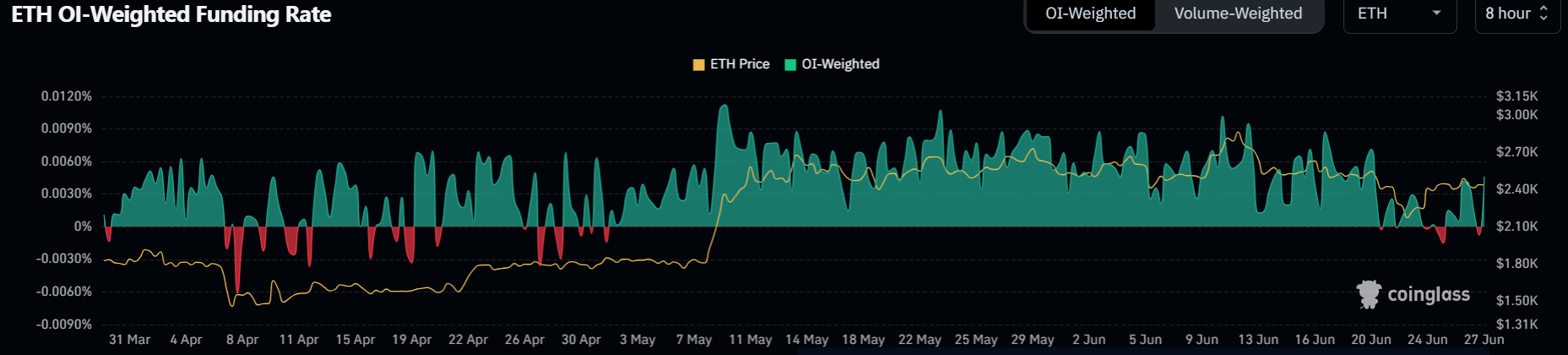

- The decline comes as Ethereum’s funding rates and weighted sentiment have shown weakness.

- ETH could suffer a 35% decline if it validates an emerging death cross signal between the 50-day and 100-day SMAs.

Ethereum shows weakness amid Trump’s cancellation of Canada trade talks

While Ethereum and most of the broader crypto market have been range-bound, stocks briefly climbed higher on Friday, with the S&P 500 and Nasdaq Composite hitting record highs.The rise comes as Commerce Secretary Howard Lutnick confirmed that the US and China have finalized a trade deal. However, both indexes have tapered those gains following Trump’s announcement that the US is terminating trade talks with Canada.“We have just been informed that Canada, a very difficult country to trade with, including the fact that they have charged our farmers as much as 400% tariffs, for years, on dairy Products, has just announced that they are putting a Digital Services Tax on our American technology companies, which is a direct and blatant attack on our Country,” Trump wrote in a Truth Social post on Friday.“Based on this egregious Tax, we are hereby terminating ALL discussions on Trade with Canada, effective immediately. We will let Canada know the Tariff that they will be paying to do business with the United States of America within the next seven days period,” he added.Following the announcement, Ethereum saw another round of modest decline, briefly dropping 1% below $2,400, with its weighted sentiment plummeting to levels last seen at the beginning of President Trump’s tariff rhetoric in early March. This suggests that retail optimism has waned compared to its earlier rise in the month despite the Israel-Iran ceasefire.%20[22-1751059455440.15.53,%2027%20Jun,%202025].png)

Ethereum Price Forecast: ETH risks 35% decline if it validates a death cross signal

Ethereum experienced $50.31 million in futures liquidations in the past 24 hours, with long and short liquidations accounting for $35.38 million and $14.93 million, respectively, according to Coinglass data.In a bid to recover from its sharp decline to $2,110 last week, ETH has risen 8.5% so far this week, returning to its familiar $2,300-$2,800 range, where it has largely traded since its spike in early May.