Mexican Peso slides against the Greenback on the fate of the “Big Beautiful Bill”

- The Mexican Peso fails to respond to rising Retail Sales, with USD/MXN breaking above 19.300

- House of Representatives’ tax bill vote remains in focus, with both bulls and bears weighing the probability of a clear move in either direction.

- USD/MXN rises above prior trendline resistance with prices heading toward 19.400.

The Mexican Peso (MXN) and the US Dollar (USD) have been anxiously waiting for the release of crucial economic data and remarks from policymakers in anticipation of the next big move.

For the Mexican Peso, the release of April’s Retail Sales figures that did little to deter the movement of the pair continues to be overshadowed by the expected path of the US Dollar and the progression of the highly anticipated upcoming new “one big beautiful bill” recently proposed by US President Donald Trump.

With Mexico Retail Sales 12:30 GMT data release beating forecasts on a monthly and annual basis, developments out of the United States overshadowed the recent report, highlighting the significance of the Greenback in the current economic environment.

Meanwhile, the projected trajectory of the Greenback remains in focus as investors await further commentary from US Federal Reserve (Fed) officials and the highly anticipated House of Representatives vote on President Donald Trump’s “One Big Beautiful Bill Act.”

Market participants are closely assessing the short- and long-term implications of the proposed tax legislation, which could significantly influence the fiscal policy outlook and investor sentiment toward the US Dollar.

Mexican Peso daily digest: USD/MXN rises on hopes for a stronger Greenback

- Mexican Retail Sales increased by 0.5% in March compared to the 0.2% rise in February, with the YoY figures smashing forecasts, coming in at 4.3%, far above the 2.2% forecasts.

- As the US Dollar drives broader market direction, shifts in USD sentiment, driven by US fiscal policy, economic data, or Fed signals, tend to dictate the short-term trajectory of USD/MXN, with the Peso reacting accordingly.

- President Trump’s “One Big Beautiful Bill” aims to extend the 2017 Tax Cuts and Jobs Act and introduce new tax relief measures.

- Suggested amendments would include State and Local Tax (SALT) deductions, which are expected to triple from $10K to $30K for married couples in the US, reducing the amount of income the government receives per tax year and placing additional pressure on the fiscal budget.

- To offset the cost of expanded tax cuts, President Trump has proposed reducing expenditure on programs associated with Medicaid, food stamps, and green energy subsidies, while reallocating funds toward defense and immigration enforcement.

- On the US side, S&P Global will release the preliminary Purchasing Managers Index (PMIs) for May and Existing Home Sales data for April on Thursday for fresh economic signals.

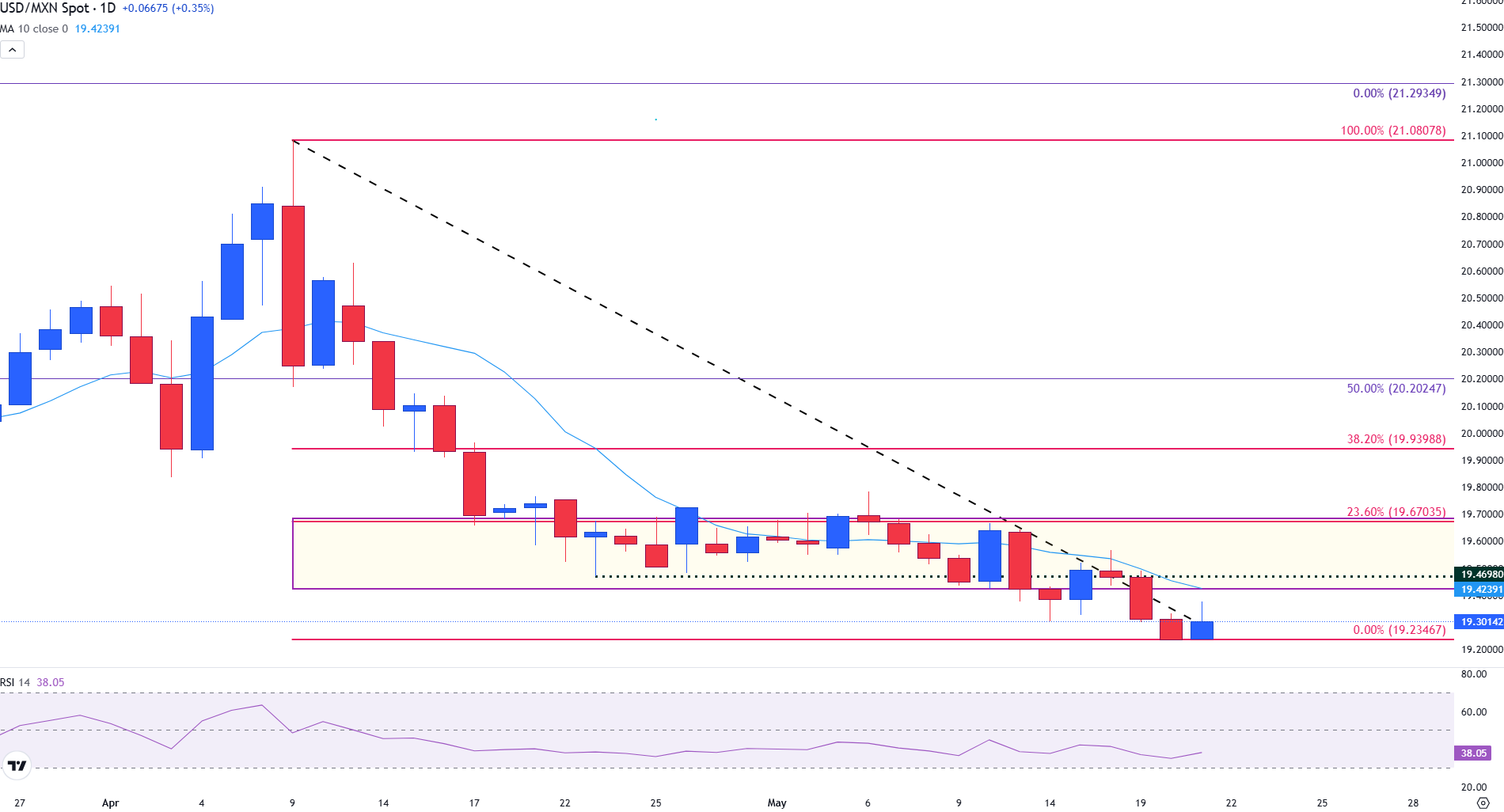

Mexican Peso technical analysis: USD/MXN trades cautiously with trendline resistance intact

The USD/MXN has recovered from its lowest level since October, breaking through the previous psychological support level, which has now turned into resistance at 19.30.

Currently, prices have risen above the prior descending trendline established from the April decline, providing an imminent barrier of support at 19.28.

USD/MXN daily chart

The Relative Strength Index (RSI) indicator has recovered above 36.00, but continues to reflect bearish momentum. Since the 30 mark is considered a potential oversold territory, the bearish trend remains intact, with the next key support level at the round number of 19.20.

On the other hand, if USD strength resurges and prices rise above the descending trendline, USD/XN could see a retest of the April low near 19.47, bringing the 20-day Simple Moving Average (SMA) into play at 19.53.