WTI Oil retreats as Middle East tensions ease, Trump holds back military move

- WTI crude pulls back after topping $75.54 on Thursday, pressured by easing geopolitical risk.

- Geneva talks between Iran and EU diplomats signal diplomatic momentum, cooling Strait of Hormuz fears.

- Trump delays decision on direct US involvement, shifting market focus back to supply fundamentals.

West Texas Intermediate (WTI) Crude Oil is trading lower on Friday, slipping to around $73.80 per barrel after touching a high of $75.54 on Thursday.

The decline reflects reduced geopolitical risk following diplomatic talks between Iran and European powers in Geneva, which helped unwind the risk premium built on Middle East tensions.

WTI slips as Geneva diplomacy calms Hormuz fears, Trump delays action

EU diplomats from France, Germany, the UK, and the EU met with Iranian Foreign Minister Abbas Araghchi in the first official engagement since hostilities between Israel and Iran escalated. While no ceasefire agreement was reached, the meeting signaled a mutual preference for diplomacy over confrontation.

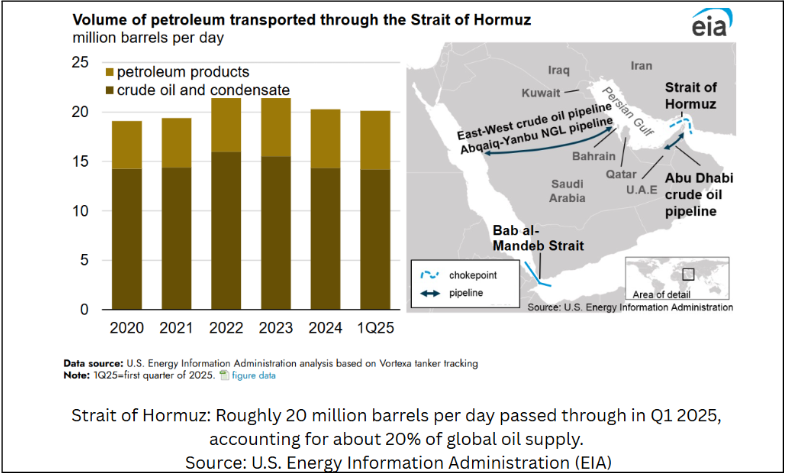

That helped calm investor concerns over potential supply disruptions, particularly around the Strait of Hormuz—a key transit point for nearly 20% of global Oil shipments.

The talks followed remarks from senior Iranian lawmaker Behnam Saeedi, who said Tehran could consider closing the Strait “if vital national interests were at risk,” but stressed it would be a last resort. Although risks remain, the absence of new threats during the Geneva talks has helped ease volatility in crude markets.

At the same time, President Trump delayed a decision on direct US military involvement, shifting market focus back toward supply fundamentals and broader sentiment.

Oil inventory data paints a tighter supply picture

On the data front, US inventory figures released this week added bullish pressure. The American Petroleum Institute (API) reported a draw of 10.13 million barrels for the week, while the Energy Information Administration (EIA) showed an even larger decline of 11.47 million barrels, with both figures far exceeding expectations and indicating tighter supply conditions in the US.

Technical analysis: WTI consolidates after gaining over 22% in June

From a technical standpoint, WTI remains above key Simple Moving Averages (SMA), with the 100-day and 200-day SMAs offering solid support at $65.78 and $68.40, respectively.

Initial support is seen at the psychological $72.00 mark, followed by the 61.8% Fibonacci retracement of the January-April decline at $69.98. Resistance stands at the June high of $75.54, with a breakout above that exposing the January high near $79.37.

The Relative Strength Index (RSI) is hovering just above 69, suggesting slightly less overbought conditions that could prompt a short-term pullback.

WTI crude Oil daily chart

Overall, crude is consolidating recent gains as diplomatic progress and tight US stockpiles pull the market in opposing directions. Traders will remain alert to further developments from Geneva and regional headlines for cues on Oil’s next move.